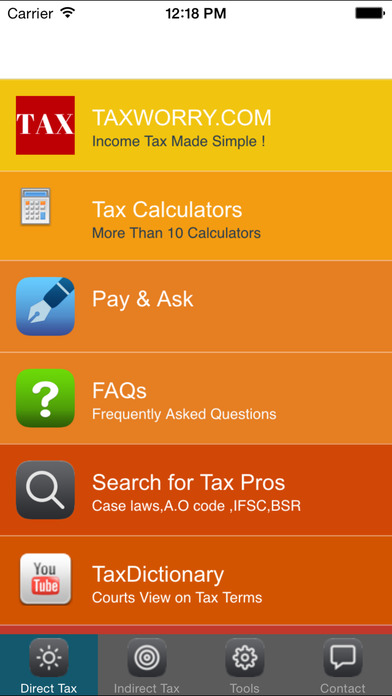

India tax and finance calculators with act & rules

The India Tax and Financial Calculators provides more than 20 tax –Income Tax and Service - . You can take it as Income Tax Ready Reckoner app , Apart from tax calculators, you can

(i) search for 40,000 high court decisions, ITAT orders ,

(ii)CBDT circulars, instructions ,

(iii) A,O Code for PAN and TAN

(iv) Tax jurisdiction

(v) Frequently Asked Questions on Income Tax & GST

Among various calculators , you get HRA tax exemption,house property income,long term capital gains,residency calculator,section 80G deduction etc. Apart from that it , service tax calulator as well as service tax reverse charge calculator for your help . financial calculators for quick help to tax professionals . So, a chartered accountant or cost accountant or a company secretary or a tax attorney or lawyer will not only get tax calculators, but also bare Acts like Income Tax Act, Income Tax Rules, Black Money Act, Rules, in the app itself. Then there are numerous quick charts on various subjects like –tax deductions, tax exemptions, penalty provisions, limitation dates, Cost Inflation Index, gold and silver rates, tax rates.

As far as calculates are concerned , the app user will get calculates for computing HRA tax exemption, house property income, long term capital gains, residency calculator, section 80G deduction. The app has more than 4 four calculators on service tax law.

One of the main feature is that app has ready and handy frequently asked questions (FAQ) answers on majority of popular tax issues like salary taxation, capital gains, TDS , non-resident tax issues .

Among the financial tools, user will get IFSC , BSR and MICR code finders of majority of Indian banks , mortgage calculators, Public Provident fund calculators

1. Search for 40,000 high court decisions, ITAT orders , CBDT circulars, instructions ,

2. More than 18 tax calculators like HRA exemption, House Property Income calculator , perquisite exemption , Long Term capital gains, Gratuity exemption calculator , Tax Residency Calculator, Agriculture Land calculator, Leave encashment exemption, retrenchment compensation tax exemption etc.

3. Frequently asked question (FAQ) module on salary, house property, capital gains, business & profession, filing of return , withholding tax or TDS, appeal before CIT(A), Tribunal, High Court, AAR . These FAQs are not just common question, but certain very typical questions on tax subjects.

4. Tax charts for quick reference to various rules, forms , time limitation. For example, you will get time limitation under Income Tax Act, Share Price as on 01/04/1981,exemptions, deductions, Income Tax Authorities, Penalties under I.T.Act , Various Forms

5. The tax app has also big plan to help students who are pursuing Chartered Accountancy ,Company Secretary or Cost Management Accountancy course . So , they can brush up their knowledge through quizzes on various topics of direct tax paper. These quizzes are arranged topics based on the syllabus of these professional exams.

6. Video - The users can watch the video listed on YouTube explaining various issues under Income Tax Act.

7. For general users, you can check the A.O code or get IFSC or MICR codes of various banks . You can do it all from this APP

8. Tax professionals who practice tax require to make calls to various tax authorities. So , a telephone directory in the app itself is helpful for them. This app has included easy searchable telephone directory of

10. Tax jurisdiction finder- A very easy way to find that tax jurisdiction of authorities. The APP has also A.O code finder

11. Income Tax Act, Income Tax Rule ebook . This will always be with you to read and refer the provision of tax law.